California REIT, (Real Estate Investment Trust), Loan Fraud - How I lost my Home with hundreds of thousands dollars in Equity, due to Breech of Loan Contract 3 days after Loan Signed, and possibly 3 other Frauds. The California Department of Real Estate Appraisers was indifferent when I sought out their help, total indifference to the Loan Breach, (because REIT loan?), due to private 3rd party non licensed indivdual interference. You can see my complaint and their response, on that tab below. The home ended up with the owner of the Loan Company, then a Real Estate Agency owner.

Breach of Contract - After Loan Notarized

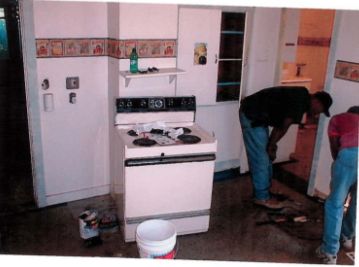

Kitchen - Before and After - Wonder how come no one bothered me or Breach a Loan when the home was in the "Before Condition", instead of after years of hard work, hundreds of thousands of dollars, etc.,.

Rear Stairway to Kitchen - Before

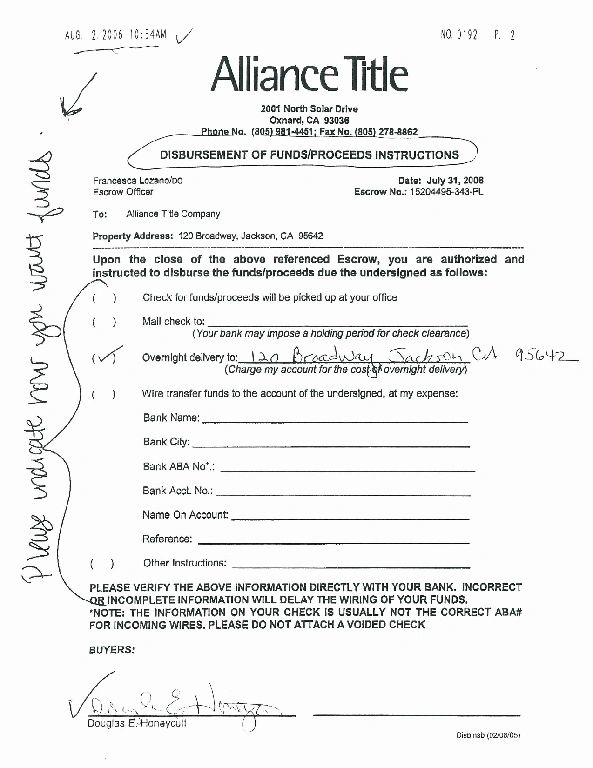

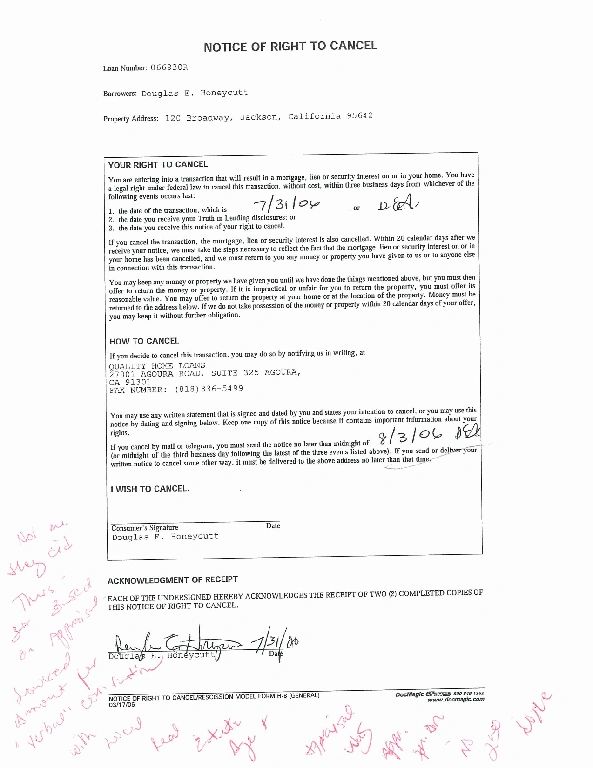

As shown on previous page, all fine in the morning of August 2nd, until after lunch.

Rear Stairwell - After, and also small Office/Day Room After photos

Afternoon of August 2, 2006, (loan signed on July 31, 2006)

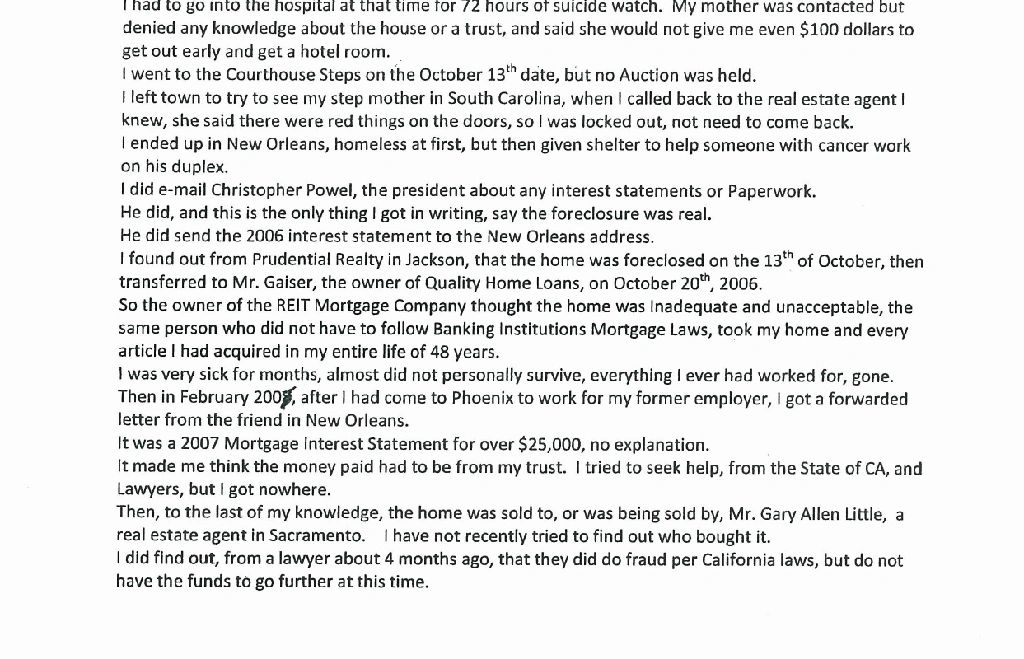

Actually it was March 15, 2010 I found out it was fraud from a CA License Attourney. As for having a Trust, this has now, ( though previously told I did), been formally denied, including when this situation landed me in the Hospital for Nervous Breakdown and Suicide Watch just 11 days before the October 13, 2006 Foreclosure date.

As for being sick during the refinance process, it is true I am HIV positive, something that should have no bearing on this at all of course. But, and thank God, I have not had an HIV related illness then or now. Interesting enough though, I was very sick in 2004 into 2005, but interesting, not when I even got my first loan with them. I had a hospital acquired infection, after being in trauma care for 9 days with a leg injury and infectiion. It was Cloustridium Difficile, (C-diff), the most deadly hospital acquired infection, antibiotic resistant and known for relapses and difficult to treat. However I was cleared of it by Mid 2005. But for some reasons, obviously some persons who knew of me being ill decided to create their own "diagnosis" and I believe might have been a reason for this finacial attack.

Again, see page below.

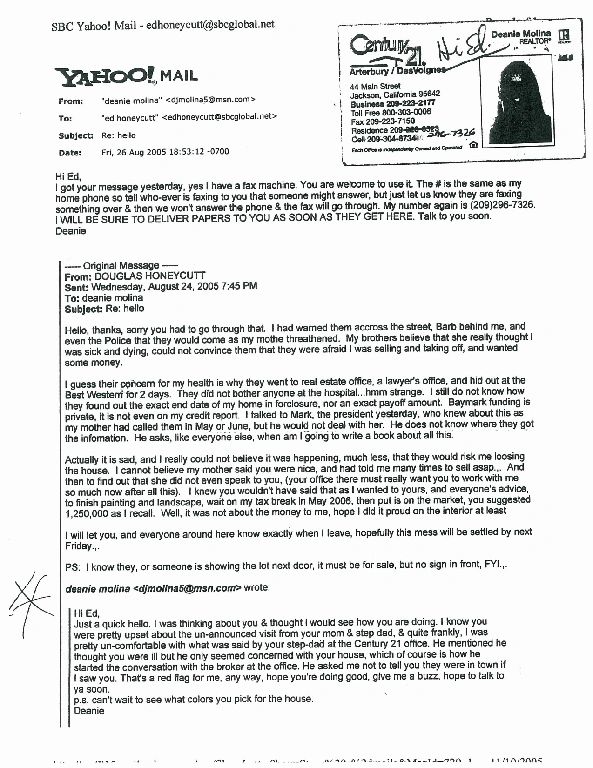

This was the only Real Estate Agent ever in the home after I purchased in 2001, Ms. Deanie Molina, August 2005. You can see the cirmstances, which had really freaked her out. My "parents" had no idea she was a friend, and owned a Victorian home just 2 doors down from me. She even said to me when she came over the next day, that when finished, the home should go on the Market for $1,250,000. Even though the comps were in the upper $700,000 range, this is a one of a kind home, the largest Victorian in the County I was told, a huge lot just 4 houses down from main street, and the best Bed and Breakfast opportunity in the town.

Deanie did move out of her house and I did not see her for months until October 12, 2006 when she came by as she heard of the Foreclosure. She also came by the next morning.

These are privacy statements in loan docs from Clear Credit Capital and Quality Home Loans saying they would not give any information to any parties not having an interest in this loan. Than how did any third party, and there was no Real Estate Agent involved in this refinance, how did information get out? Only one Real Estate agent had ever been in the house since I purchase it, see last page below.

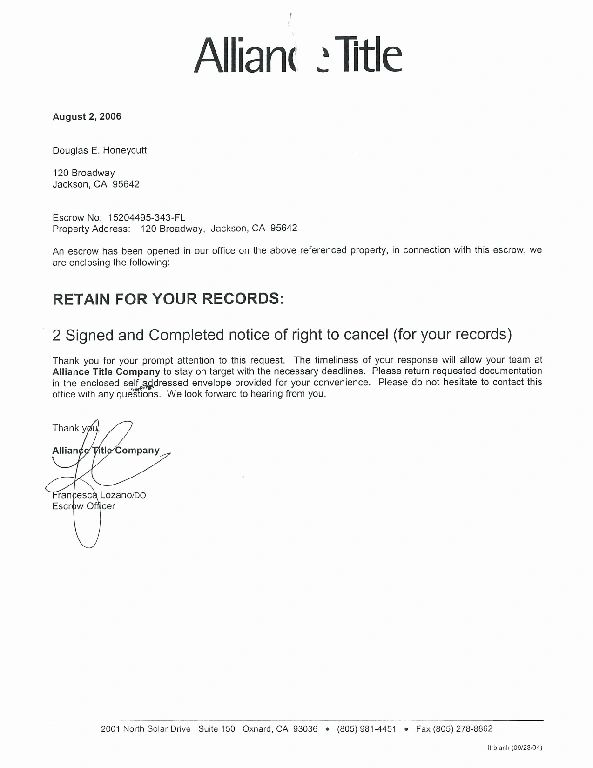

Right to Cancel Notices mailed August 2, 2006. I did not recind of course.

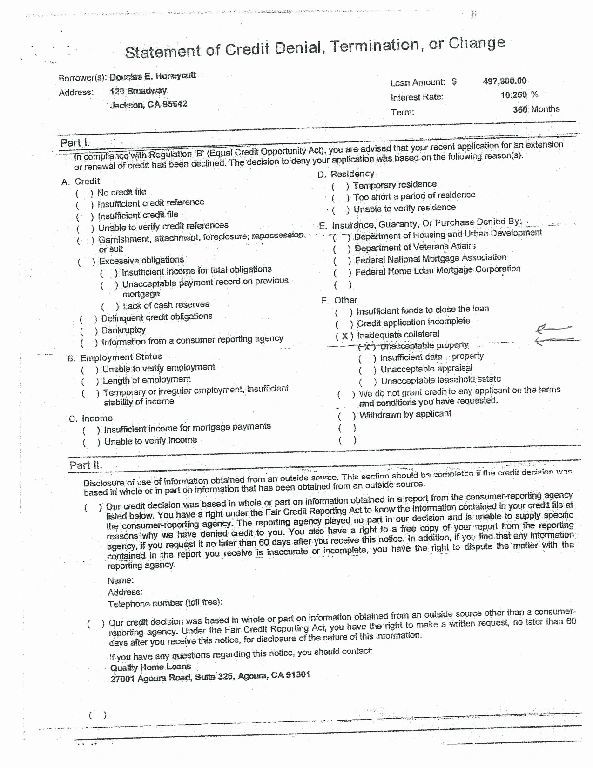

After the loan Breech on August 2nd, this was the only paperwork I received, until 2007. This is a Credit Denial bases on "inadequate Colleral and Unacceptable Property! They already had the loan on the Home, I had completed more renovations and most notable is that is was not so Unacceptable to be taken over by the Owner of Quality Home Loans.

Dated 9/16/2006

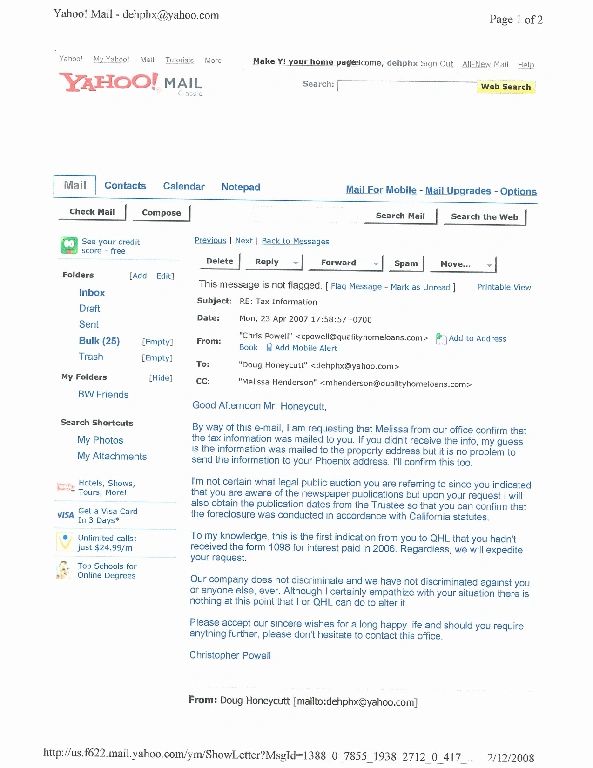

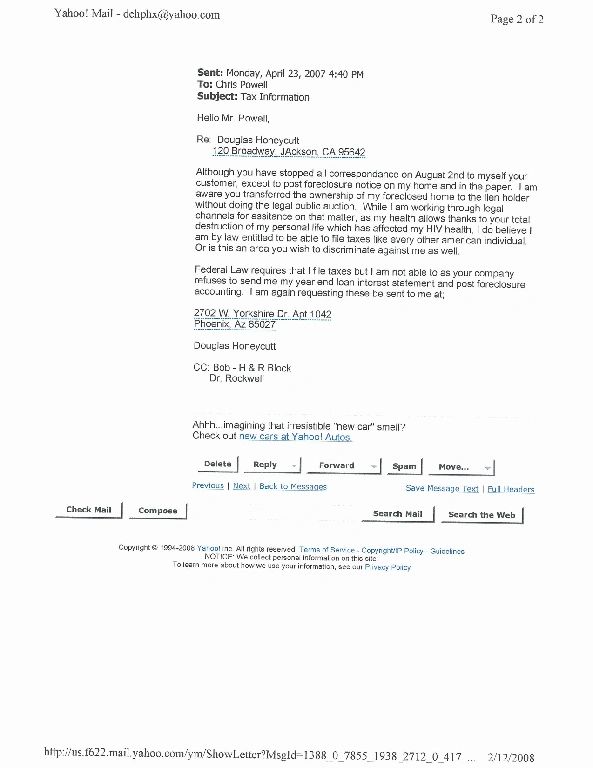

This FAX which I initiated to Mr. Christopher Powell about an interest statement, (after I got a job and settled in Phoenix still in shock), is the only paperwork I got confirming the Foreclosure took place. By FAX no other Foreclosure related paperwok what so ever.

I guess since there was no Public Option, the Owner of Quality Home Loans got my home for $425,000, and not the expect 8 figures it might bring, or ever the $766,000 appraisal. And the president of the company, was the one who over saw all the decisions made this day they did not fund the loan and breached it. This is where their business actions have led them, to this class action lawsuit against Quality Home Loans, you can click on the link to see.

http://dockets.justia.com/docket/california/cacdce/2:2008cv03113/415496/

Upstairs Landing - After (do not have all photos, lost everything, luckily had these with loan docs I left with friends).