California REIT, (Real Estate Investment Trust), Loan Fraud - How I lost my Home with hundreds of thousands dollars in Equity, due to Breech of Loan Contract 3 days after Loan Signed, and possibly 3 other Frauds. The California Department of Real Estate Appraisers was indifferent when I sought out their help, total indifference to the Loan Breach, (because REIT loan?), due to private 3rd party non licensed indivdual interference. You can see my complaint and their response, on that tab below. The home ended up with the owner of the Loan Company, then a Real Estate Agency owner.

IRS Review and Acknowledgement

Upstairs Main Bath - After

The reason these forms are on here is the fact that the IRS actually acknowledged me as being a "Hardship" case and lowered my payments.

I did owe them a substancial amount of money which hit right after I had met with the California License Lawyer, and took about 7 months of my time.

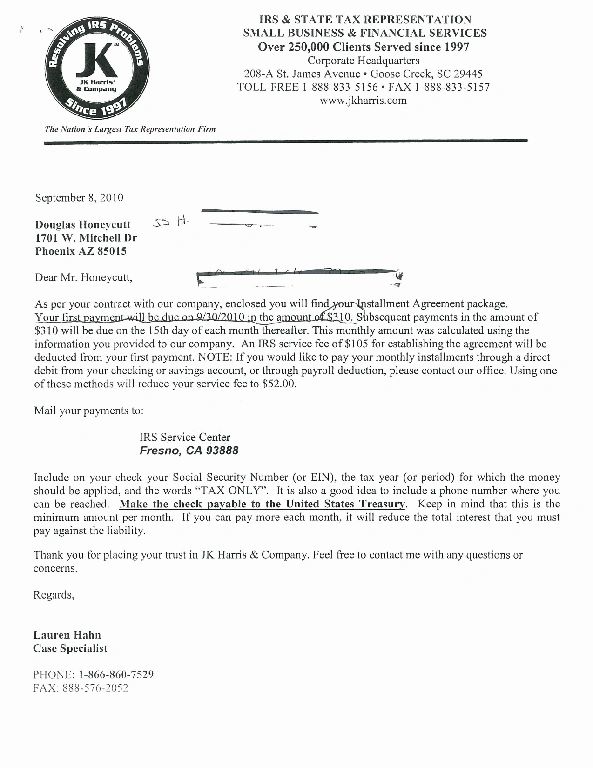

So I hired JK Harris to do my returns, and over $1,300 to negotiate a payment schedule, as you can from the correspondance below. They informed me that my monthly payment would be $310 for 60 months. As you can also see below, the IRS responded with a demand for $1,328 monthly payments. I could not get a returned phone call or e-mail from JK Harris.

I contacted the IRS about the matter. I was informed that no Tax agency can decide the monthly payment amount, that the IRS had ONE set payment calculator based on salary and amounts owed. The $310 was a "Hardship amount Payment" that JK Harris submitted, but was not accepted. I told them I knew I owed the money but lost all my equity, which was money to pay them, in a Real Estate Breach of Contract.

It was then that I told her my story, all the information you have seen on this site. I had wanted JK Harris to do so but was told unless it was an asset, it had no bearing. I sent 28 pages of the Fraud-Breach of Contract information, explaining it in a letter dated December 2, 2010 and mailed it on the 3rd.

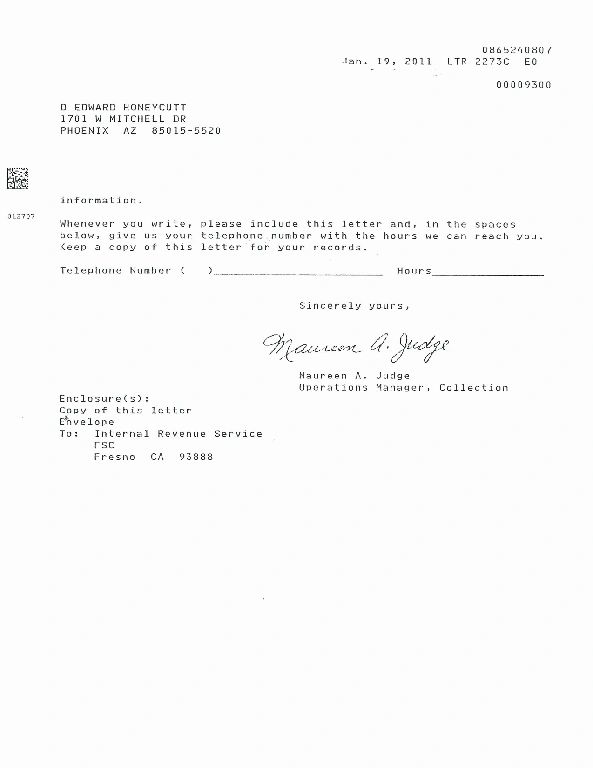

The IRS, a huge National Government department reviewed the information, and actually did change my Payments to the Hardship, $310 amount.

I am sure that they did not do this because I made a bad business decision, but because they were convinced this loss on mine was out of my control and due to the actions previously described. I thank the IRS for this action.